Irs Fire System Instructions

If you fail to establish a valid secret phrase. The most efficient way to submit an application to file information returns electronically is to submit the Fill-in Form 4419 Application for Filing Information Returns Electronically FIRE from the FIRE home page.

1099 Electronic Filing How To Upload 1099 Efile To Irs Site

FIRE accounts require the user to establish a secret phrase to assist in resetting passwords for FIRE Systems Production and Test.

Irs fire system instructions. This is the application for obtaining a Transmitter Control Code TCC which helps the IRS keep the system secure. Form 4419 is mandated to be electronically filed when requesting an original TCC first-time application. The IRS will not mail error reports for files that are bad.

5-2020 when you have an existing Transmitter Control Code TCC to. Obtaining a TCC code is a very simple process that only requires sending a fax to the IRS and you call them in a week or so to get the code. There is a minimum of two contacts required with a maximum of fifty contacts.

How to Use the IRS FIRE System First and foremost the IRS needs a way to verify that the electronic submissions they receive are coming from the businesspayer. Note to Existing IRS FIRE System Users If you have already configured your computer to connect to the IRS FIRE system and submitted using the FIRE system last year see the Subsequent Connections to the FIRE System section of the IRS P3609 when it is made available to get started quickly. Form 4419 Application For Filing Information Returns Electronically FIRE to IRSECC-MTB no later than 45 days before the due date of your information returns.

Please seethe IRS Resources. You will receive verification within seconds of. Notes Click here for IRS FIRE System ALERTS and.

Please see the IRS Resources section at the beginning of this document for details on what P3609 covers. This Quick Start Guide will walk you through submitting your 1099s electronically to the IRS FIRE Filing Information Returns Electronically system. You will need a User ID and Password to begin using this application.

IRS FIRE system guide The IRS created a PDF walkthrough guide P3609 for FIRE users. For files submitted on the FIRE System it is the responsibility of the filer to check the status within 5 business days to verify the results of the transmission. ILING WITH THE IRS FIRE SYSTEM PRO1099 - SELECT 11212018 p5 IRS FIRE system guide The IRS created pdf walkthrough guide P3609 for FIRE users.

Using the IRS FIRE System. Submit a paper Form 4419 Rev. FILING WITH THE IRS FIRE SYSTEM PRO1099- STDENT 1202016 3 About The IRS FIRE System The FIRE System is a website maintained by the Internal Revenue Service IRS that you can use to electronically file your IRSTAX file directly with the IRS.

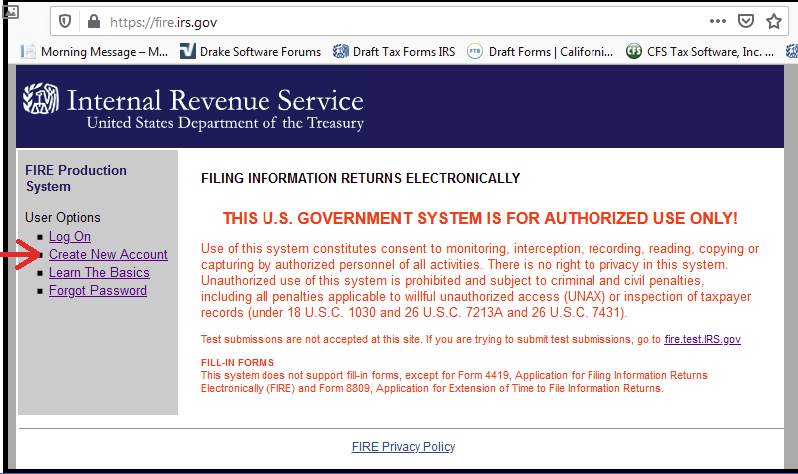

Filing Information Returns Electronically FIRE system IRS. A Contact is authorized to use your TCC to file information returns electronically through the FIRE System. If you do not already have an account click Create New Account to start setting up your new account.

The 4419 form is accessible at the IRS FIRE login site. Otherwise you can enter your assigned User ID and the password you have chosen to begin using this. Submit an online Fill-in Form 4419 located within the FIRE System at httpsfireirsgov.

As of October 1 2019 Form 4419 Application for Filing Information Returns Electronically FIRE is mandated to be electronically filed when requesting an original TCC. All electronic filing of Information Returns are received at IRSIRB via FIRE F iling I nformation R eturns E lectronically. IRS Resources The IRS maintains documentation for their FIRE system.

How to Create and Upload An IRSTAX Transmittal to the IRS FIRE System. How to transmit through FIRE. In order to use IRS FIRE software you will need a TCC code which is like a password to e-File with IRS.

10Software 10Form Software print 2efile Just click a button and the 10software will automatically and upload your file to the IRS. If you file 250 or more 1099s the IRS requires you to submit them either electronically or magnetically. If you already have a FIRE System account Production and Test but dont have a secret phrase you will be prompted to create one the first time you log into the system.

You may also go to Forms and Pubs and select the paper version of Form 4419. FIRE is designed to support the electronic filing of Information Returns only. If you are trying to submit test submissions go to firetestIRSgov FILL-IN FORMS This system does not support fill-in forms except for Form 4419 Application for Filing Information Returns Electronically FIRE and Form 8809 Application for Extension of Time to File Information Returns.

The IRS FIRE System FIRE is dedicated exclusively to the filing of Forms 1042-S 1098 1099 3921 3922 5498 8027 8935 and W-2G. After the IRS receives your application the IRSECC-MTB will issue a TCC. A TCC is required to transmit information returns through the FIRE system.

Fields with an are required. 1187 Specifications for Electronic Filing of Form 1042-S Foreign Persons US. SoftPro advises that you reference their.

Contacts are required on all applications. If you file fewer than 250 you may submit them electronically with the FIRE system or you may submit them manually by. Create FIRE System Account IRS FIRE Home Create FIRE System Account.

For compliance purposes SoftPro recommends that Pro1099 users reference this guide when submitting their IRSTAX files. For compliance purposes SoftPro recommends that Pro1099 users reference this guide when submitting their IRSTAX files. Contacts are responsible for answering IRS questions regarding any transmission or processing issues.

Accessing the FIRE site. Submit an online Fill-in Form 4419 located within the FIRE System at httpsfireirsgov. You will be prompted to create the secret phrase at the same time you create your User ID Password and valid 10-digit PIN.

To do this the IRS requires payers to file Form 4419.

Taxseer Com Is A Money And Time Saving Ally For Small Business Irs Forms Irs Filing Taxes

Bdsdongnama Com The Best Article Collection Regular Updated Contains Remarkable Contents Web Design London Johnny Be Good Web Design

1099s Electronic Filing How To Upload 1099s Efile To Irs Site

Https Www Irs Gov Pub Irs Pdf P1516 Pdf

1099 Combined Federal State Program E Filing Das 1099

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

1099s Electronic Filing How To Upload 1099s Efile To Irs Site

Most Fire Extinguishers Used In The Hospital Are Class A B C 1 A Used On Wood Cloth Paper 2 B Used On Grease Propane Flammable Liqui Pinteres

Hey Truckers Here Are Some Important Do S And Don Ts You Should Know While E Filing Your Form 2290 Filing Taxes Trip Donts

1099s Electronic Filing How To Upload 1099s Efile To Irs Site

Applying For A Transmitter Control Code Tcc Cfs Tax Software Inc

Account Ability S Integrated Browser Retrieves The User Id Password And Pin Entered On The Integrated Browser Page Of The Transmit Fire Systems Irs Accounting

1099 Electronic Filing How To Upload 1099 Efile To Irs Site

Income Tax Form Number 4 Exciting Parts Of Attending Income Tax Form Number Tax Forms Income Tax Income

Post a Comment for "Irs Fire System Instructions"