Electronic Home Appliances Gst Hsn Code

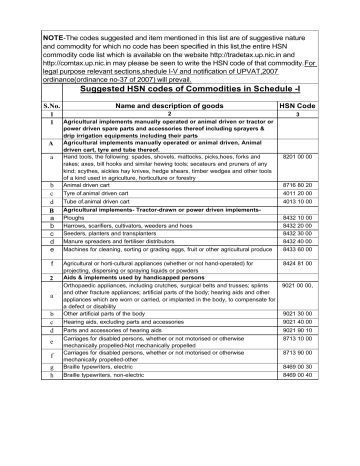

The hsn stands for harmonized system of nomenclature. Also get HS code list under heading 8509.

Gst Hsn Code In Excel Format Free Download Cakart

64 lignes HSN Code GST Rate for Electrical and electronic products - Chapter 85.

Electronic home appliances gst hsn code. Boards panels consoles desks cabinets and other bases equipped with two or more apparatus of heading 8535 or 8536 for electric control or the distribution of electricity including those incorporating instruments or apparatus of chapter 90 and numerical control apparatus other than switching. Also get HS code list under heading 85. Home appliances become the backbone of the space.

Sir i am the dealer selling home appliances products i have stock of some appliances 28 now according to new. All HS Codes or HSN Codes for home appliances with GST Rates HSN Code 8509 Electromechanical domestic appliances with self-contained electric motor. 11 lignes Home appliances Import Data and Export Data Home appliances HS code for Import.

Machinery for filling closing sealing or labelling bottles cans boxes bags or other containers. The HSN codes are arranged in no particular order and the exportimport code is written as a suffix to their HSN codes. Hsn Code For Electronic Home Appliances.

Other packing or wrapping machinery incl. The export import data from Seair paves the way for successful partnerships that. Electrical home appliances Import Data and Export Data Electrical home appliances HS code for Import and Export The Electrical home appliances import export trade sector contributes significantly to the overall GDP percentage of India.

All HS Codes or HSN Codes for electrical appliances with GST Rates HSN Code 7321 Stoves ranges grates cookers incl. GST Rates with HSN code on Household Electrical Devices Appliances. Search HSN code for Home Appliances in India.

No wonder the port is booming in this sector and at Seair we better understand how to benefit you from. The table below shows the HSN Codes for Electronics and other Electrical Parts. All HS Codes or HSN Codes for appliance with GST Rates.

Our Kitchen appliances import data and export data solutions meet your actual import and export requirements in quality volume seasonality and geography. Parts thereof excluding vacuum cleaners dry and wet vacuum cleaners. Those with subsidiary boilers for central heating barbecues braziers gas rings plate warmers and similar non-electric domestic appliances and parts thereof of iron or steel excluding boilers and radiators for central heating geysers and hot water cylinders.

Sound recorders and reproducers television. Diagnostic or laboratory reagents on a backing prepared diagnostic or laboratory reagents whether or not on a backing and certified reference materials excluding compound diagnostic reagents designed to be administered to the patient blood-grouping reagents animal blood prepared for therapeutic prophylactic or diagnostic uses and vaccines toxins cultures of micro. You can search latest GST rate with the description of Goods Services or HSN code at CBIC official website.

Machinery for capsuling bottles jars tubes and similar containers. All HS Codes or HSN Codes for electronics home appliances with GST Rates HSN Code 8509 Electromechanical domestic appliances with self-contained electric motor. Machinery for cleaning or drying bottles or other containers.

HS Code Of Chapter 8509 List Of Hs Codes For ELECTRO-MECHANICAL DOMESTIC APPLIANCES WITH SELF-CONTAINED ELECTRIC MOTOR Free Search Indian HS Classifications. Parts thereof excluding vacuum cleaners dry and wet vacuum cleaners HSN Code 9503. Get HSN codes of 8509 - Domestic appliances incorporating electric motor.

Electrical capacitors fixed variable or adjustable pre-set Import Data. Search HSN code for Electronic Goods in India. HSN Code and GST Rate for Electronics and other Electrical Parts.

When it comes to buying new electronic products and appliances it can be exciting yet daunting. This system has been introduced for the systematic classification of goods all over the world. Hsn Code For Electronic Home Appliances.

Generally there are four rates such as 5 12 18 28 under GST. You can see below the complete list of hsn codes in gst in india for services. Its main products are fashion and jewelry electronics home and entertainment and health and beauty areas.

Also there are Zero rated Nil rated and Exempted category under GST. Get HSN codes of 85 - Electrical electronic equipment. Alongside we help you get detailed information on the vital export and import fields that encompass HS codes product description duty quantity price etc.

Gst Rate Hsn Code For Electrical Parts Electronics Chapter 85 Pdf Ignition System Electric Motor

Exempted Goods Under Gst With Hsn Code

Gst Rate And Hsn Code For Mechanical Electrical Appliances Indiafilings

28 Gst Rate Items Hsn Code For Goods As On April 2020 Aubsp

Gst Rate For Electronics Television And Audio Equipment Indiafilings

Hsn Code Gst Rate For Electrical And Electronic Products Chapter 85 Tax2win

Gst Hsn Code Tax Rate Finder For Android Apk Download

Hsn Code List Gst Rate Find Gst Rate Of Hsn Code Hostbooks

List Of Hsn Code With Tax Rates Gst E Startup India

Gst Rate Hsn Code For Electrical Parts Electronics Chapter 85 Pdf Ignition System Electric Motor

18 Gst Rate Items Hsn Code For Goods As On April 2020 Aubsp

Gst Rates With Hsn Code On Household Electrical Devices Appliances

Annapurna Items Gst And Hsn Code And Arhar Dall Rate 86 Facebook

Hsn Code For Machinery Electrical Under Gst Hsn Codes Legalraasta

Hsn Codes Upto 4 Digit Level Under Gst Legalraasta

Suggested Hsn Codes Of Commodities In Schedule Manualzz

Post a Comment for "Electronic Home Appliances Gst Hsn Code"